When Will I Get My 2025 IRS Tax Refund?

Tax season is here, and millions of Americans are asking the same question: “When will I get my tax refund?” If you’re expecting a refund this year, knowing the IRS tax refund schedule 2025 can help you plan.

The IRS began accepting 2024 tax returns on January 27, 2025, and expects to process over 140 million returns by the April 15 deadline.

Most taxpayers who file electronically and opt for direct deposit can expect to receive their IRS refund within 21 days. However, factors like tax credits, IRS processing times, and filing errors can affect your IRS refund timeline.

Below, we break down the 2025 IRS tax refund schedule, explain common delays, and show you how to use the Where’s My Refund tool to track your refund.

How to Track Your IRS Tax Refund Status

If you’ve already filed your return, you can monitor its progress using the IRS Where’s My Refund tool or other tracking methods.

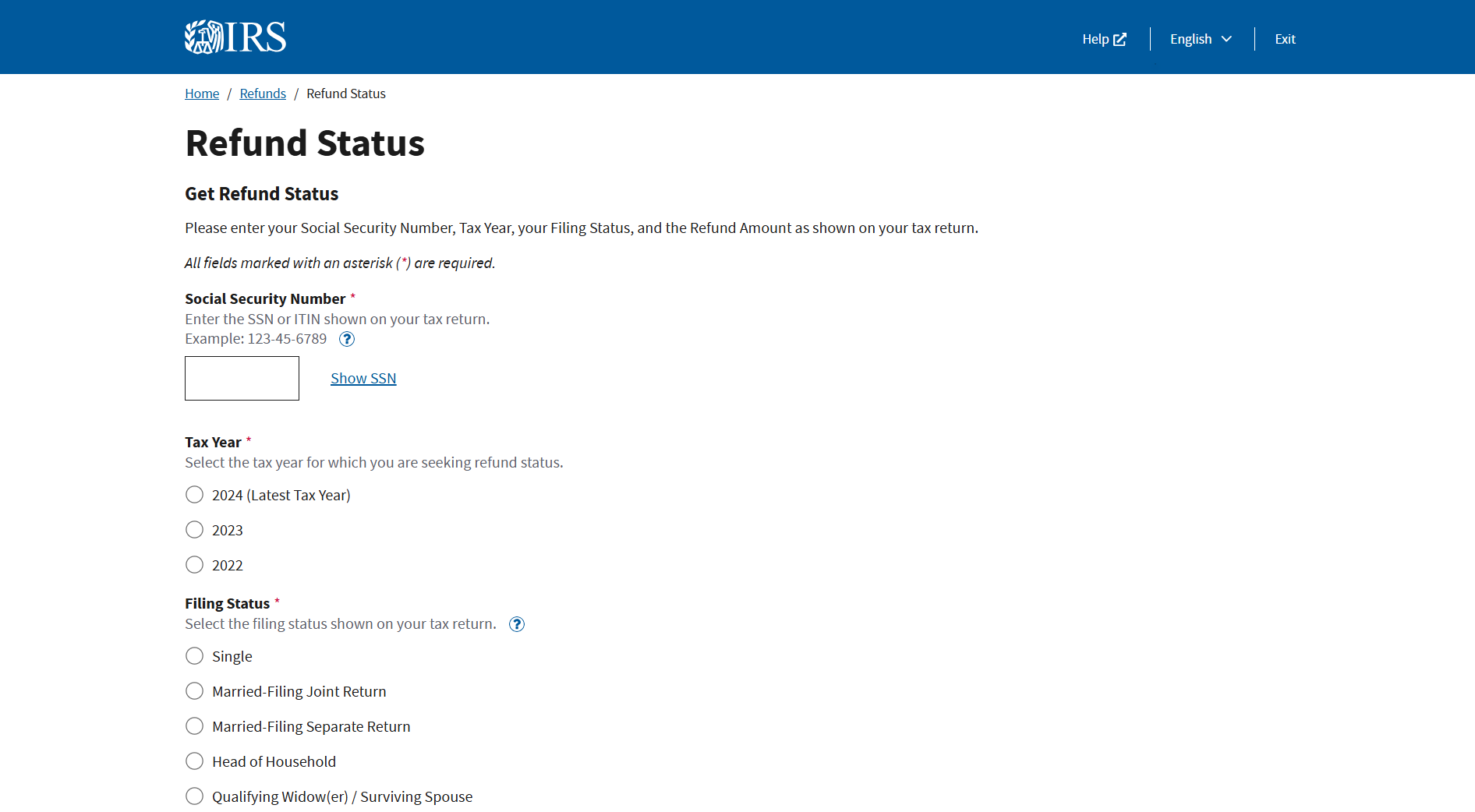

Use the IRS Where’s My Refund Tool

The fastest way to check your IRS refund timeline is through the Where’s My Refund tool on the IRS website.

1. What You Need to Check Your Refund Status:

- Your Social Security number (SSN)

- Your filing status (Single, Married, etc.)

- The exact dollar amount of your refund

2. When Does the Tool Update?

- 24 hours after e-filing

- 4 weeks after mailing a paper return

Other Ways to Track Your IRS Tax Refund

If you prefer, you can also check your IRS refund timeline by:

- Calling the IRS Refund Hotline: 800-829-1954 (available 24/7)

- Using the IRS2Go mobile app for real-time refund tracking

IRS Tax Refund Schedule 2025: When to Expect Your Payment

Your refund timing depends on how you file and how you receive your refund.

IRS Refund Timeline Based on Filing Method

| Filing Method | Estimated Refund Timing |

|---|---|

| E-file with direct deposit | Within 21 days |

| E-file with mailed check | 4 weeks |

| Mailed return with direct deposit | 4 to 8 weeks |

| Mailed return with a check | 4 to 9 weeks |

IRS Tax Refund Schedule 2025 (Estimated Dates)

While the IRS does not provide an official refund calendar, here are estimated 2025 IRS tax refund dates based on past trends.

| Return Filed & Accepted | Direct Deposit Refund Date | Mailed Check Refund Date |

|---|---|---|

| January 27 | February 17 | March 28 |

| February 3 | February 24 | April 4 |

| February 10 | March 3 | April 11 |

| February 17* | March 10 | April 18 |

| February 24 | March 17 | April 25 |

| March 3 | March 24 | May 2 |

| March 10 | March 31 | May 9 |

| March 17 | April 7 | May 16 |

| March 24 | April 14 | May 23 |

| March 31 | April 21 | May 30 |

| April 7 | April 28 | June 6 |

| April 15 | May 6 | June 16 |

Note: These dates are estimates. Delays can occur due to tax credits, IRS backlogs, or errors in your return.

Why Your 2025 IRS Tax Refund Might Be Delayed

Even if you file early, some factors could slow down your IRS refund timeline:

1. Claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC)

Under the PATH Act, refunds for these credits cannot be issued before February 15, 2025. If you claimed these, expect your refund in late February or early March.

2. Filing During Peak Season

Filing between late March and mid-April could slow down processing times due to high IRS volume.

3. Errors in Your Tax Return

Mistakes such as incorrect personal details, mismatched numbers, or missing forms can trigger an IRS review, delaying your 2025 IRS tax refund.

4. IRS Processing Delays

Due to IRS staffing shortages, some refunds may take longer to process, especially for paper filers.

5. Outstanding Tax Liabilities

If you owe money to the IRS, student loans, or child support, the IRS may apply part or all of your IRS tax refund to settle those debts.

State Tax Refund Status: When Will You Get Yours?

Each state tax refund follows a different timeline.

🔹 North Carolina: Paper filers may wait up to 3 months for a refund.

🔹 Oklahoma: Refunds typically arrive 5-6 weeks after acceptance.

To check your state tax refund status, visit your state’s Department of Revenue website.

2025 IRS Direct File: Can You File for Free?

The IRS Direct File program has expanded to 25 states in 2025, offering free online tax filing for simple returns.

💡 Who Can Use Direct File?

- Single filers with wages under $200,000

- No gig work or rental income

- Limited tax situations

Check your Direct File eligibility on the IRS website.

Key Takeaways: 2025 IRS Tax Refund Schedule & Tracking

- Most 2025 IRS tax refunds arrive within 21 days for e-filed returns with direct deposit.

- Use the IRS Where’s My Refund tool to track your payment.

- Paper returns take 4 to 9 weeks to process.

- EITC & ACTC refunds won’t be issued before February 15.

- State tax refund schedules vary—check your state’s revenue website for updates.

Final Tip: File Early & Electronically for the Fastest Refund

The IRS strongly recommends e-filing with direct deposit to get your refund faster and reduce the risk of errors. If you haven’t filed yet, use IRS Free File or Direct File for a quick, secure, and cost-free filing option.

Claire Bennett is a seasoned finance writer with over 8 years of experience, specializing in personal finance and investment strategies. She has contributed to top media outlets like Forbes and Business Insider.