Recently, the Bank of England announced a rate cut—a decision that has significant implications for the cost of borrowing across the country. On February 6, 2025, the Bank of England reduced its base rate from 4.75% to 4.50%, marking its third reduction in six months. This move is aimed at stimulating economic activity by lowering borrowing costs. For homeowners, this development presents a timely opportunity to refinance their mortgage. Refinancing in the wake of a rate cut can lead to lower monthly repayments and reduced long-term interest costs.

In this article, I will provide a detailed, step-by-step guide to refinancing your mortgage so that you can capitalize on these savings and improve your overall financial health.

What is the Recent Interest Rate Cuts by the Bank of England?

A Bank of England rate cut occurs when the Monetary Policy Committee (MPC) decides to lower the base interest rate at which commercial banks can borrow money. This rate serves as a benchmark for many lending products, including mortgages. According to official statements and historical data, rate cuts are implemented to encourage spending and investment by making loans less expensive.

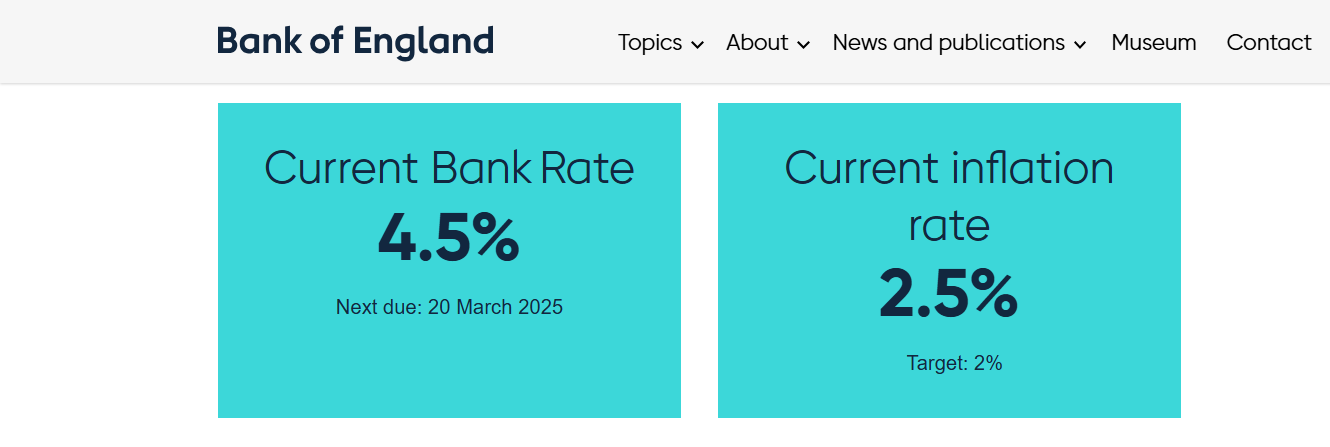

Over the past few years, following periods of high inflation and cautious economic recovery, the Bank of England has adjusted its rates several times. The recent cut from 4.75% to 4.5% is part of this ongoing effort to maintain economic stability.

Impact on Mortgage Rates

The base rate is a key influence on mortgage rates. When the Bank of England lowers the base rate, lenders typically reduce interest rates on both variable and fixed-rate mortgages. For homeowners, this means the cost of borrowing decreases, leading to lower monthly repayments. Variable-rate mortgages usually adjust quickly to changes in the base rate, while fixed-rate mortgages will reflect the lower rates when you take out a new loan or refinance an existing one.

Benefits of Mortgage Refinancing

Cost Savings

One of the main reasons to refinance your mortgage is to save money. With a lower interest rate, your monthly repayments can be significantly reduced. For example, a 0.25% drop in the interest rate could save you hundreds of pounds over the life of a 25- or 30-year mortgage. Over time, this means paying less interest and lowering the overall cost of the loan.

Improved Financial Health

Refinancing can improve your cash flow by lowering monthly repayments and reducing long-term interest costs. This extra money each month can be used to build savings, invest in other areas, or pay off other debts. For example, if you save £200 a month, you could use it to add to your pension or pay down a credit card. In the long run, refinancing can help improve your overall financial stability and wellbeing.

How to Refinance Your Mortgage?

Step 1: Evaluate Your Financial Position

Before refinancing, it’s important to review your current financial situation:

- Current Mortgage Details: Collect information about your existing mortgage, including the interest rate, remaining term, and outstanding balance. This will help you compare potential savings.

- Credit Score Check: Your credit score affects the interest rate you can get. Check your credit report and fix any mistakes.

- Financial Goals: Decide what you want to achieve with refinancing. Do you want to lower monthly payments, shorten the loan term, or use your home equity for other financial needs?

Step 2: Explore Lenders and Mortgage Products

Next, research the available mortgage refinancing options:

- Comparison of Lenders: Different banks and lenders offer various mortgage products. It’s important to compare their offers as interest rates, fees, and terms can vary significantly.

- Key Factors to Consider: Focus on the total cost of the new mortgage, including the interest rate, processing fees, prepayment penalties, and any additional charges. This ensures that refinancing will provide the expected savings.

- Use of Comparison Tools: Use online mortgage calculators and comparison websites like MoneySupermarket, ComparetheMarket, and others. These tools can help you input your details and compare different scenarios to make an informed decision.

Step 3: Prepare the Required Documentation

A smooth refinancing process depends on thorough preparation:

- List of Documents: Typically, lenders require proof of income (such as payslips or tax returns), bank statements, property documents (such as the title deed), and your current mortgage statement. Ensuring that you have all necessary documents will help expedite the process.

- Tips for a Smooth Application: Organize your documentation in advance and consider making digital copies. This preparation not only speeds up the review process but also minimizes the likelihood of delays during underwriting.

Step 4: Application Process and Approval

Once you have chosen a lender and gathered your documents, you can begin the application:

- Application Submission: Submit your application either online or by visiting a branch. Most modern lenders offer a streamlined online process, making it easier and faster.

- Approval Process: Your application will be assessed through underwriting, where the lender verifies your financial details and the value of your property. Understand that this process may take several weeks, so plan accordingly.

- Negotiating Terms: Even after receiving an offer, do not hesitate to negotiate. Ask about the possibility of lowering fees or securing a more favorable interest rate. A well-prepared borrower can often secure better terms by discussing the details with the lender.

Step 5: Switching Lender and Finalizing the Deal

The final stage involves legal and administrative procedures:

- Legal and Administrative Steps: Once your application is approved, you will need to sign the new loan agreement. This may involve engaging a solicitor or a licensed conveyancer to ensure that the transfer of the mortgage is legally compliant.

- Settlement and Transition: After the legal formalities are completed, the new lender will settle the outstanding balance on your existing mortgage, and you will start making payments under the new terms. Be sure to understand any fees associated with this transition and confirm the effective date of the change.

Risks to Be Remember

While refinancing can offer increased benefits, it’s important to consider the potential risks:

- Potential Fees and Penalties: Refinancing might involve various fees, such as early repayment charges on your existing mortgage, valuation fees, and processing fees. Be sure to include these in your calculations.

- Rate Fluctuations: While current rates are favorable after the Bank of England’s rate cut, future interest rate changes could impact your savings. Think about whether you prefer the stability of a fixed rate or the potential variability of a variable rate.

- Long-Term Commitment: Refinancing often means committing to new loan terms, which could be long-term. Make sure the new terms align with your long-term financial goals and situation.

Have Question? Read Below

On February 3, 2025, the Bank of England reduced its base rate from 3.75% to 3.50% to stimulate economic growth.

A rate cut typically leads to lower mortgage rates, especially for variable rate mortgages, as lenders adjust their borrowing costs. This can reduce monthly repayments and lower overall interest expenses.

Commonly required documents include proof of income (payslips, tax returns), bank statements, property documents (title deed), and your current mortgage statement.

Risks include incurring fees (such as early repayment charges and valuation fees), potential future interest rate fluctuations, and the long-term commitment associated with a new mortgage term.