Have you received a text message from the IRS about a $1,400 stimulus check? If so, you’re not alone. Many people have reported receiving similar messages, but before you get excited, let’s break it down. Is it real? The short answer—no! Let’s dive into the details so you don’t fall victim to a scam.

The Fake IRS Text Message

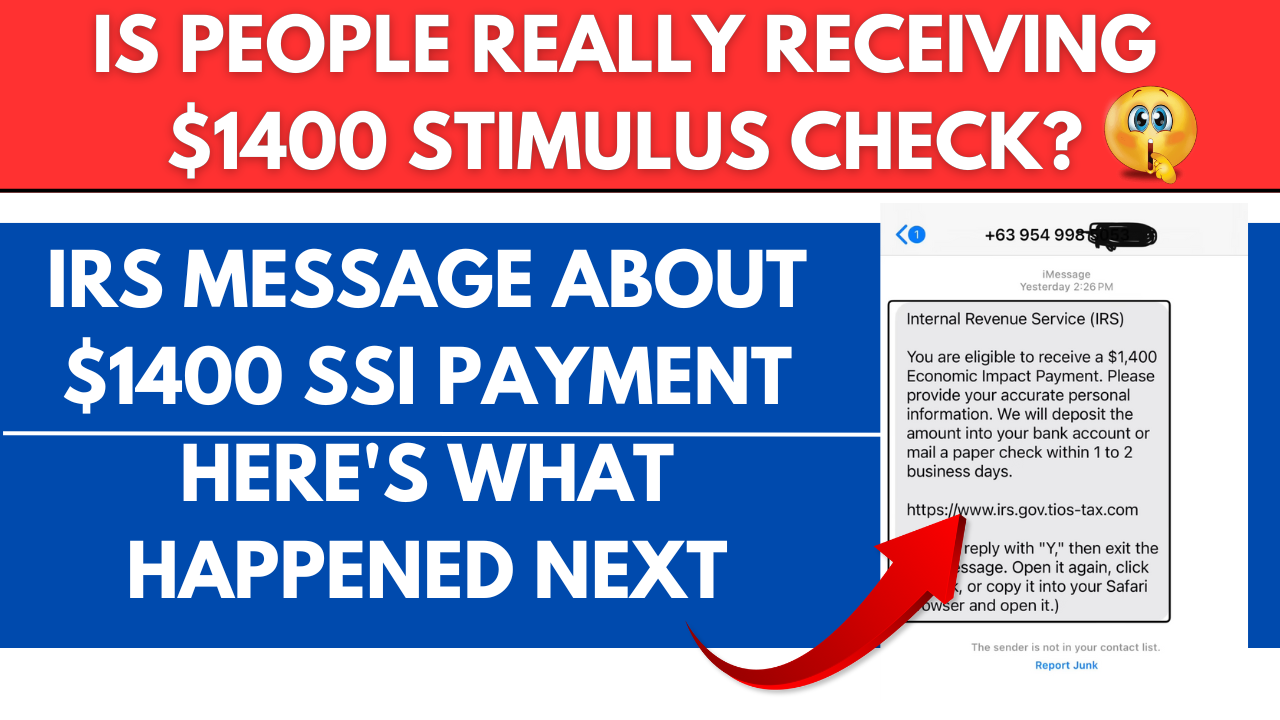

Recently, I received a text message claiming to be from the IRS about a $1,400 economic impact payment. The message looked legitimate at first glance, complete with IRS branding and a link to claim the payment.

However, upon closer inspection, there were several red flags that exposed it as a scam:

- The Sender’s Phone Number – The message came from a number with the country code +63, which is for the Philippines. The IRS, a U.S. government agency, would never contact you from an international number.

- IRS Communication Methods – The IRS does not send unsolicited text messages, emails, or phone calls about stimulus payments. Official communication always comes via mail.

- The Suspicious Website Link – The message contained a link that appeared to start with ‘irs.gov,’ but upon further inspection, it ended in ‘.com’ instead of ‘.gov.’ This is a major red flag, as official IRS websites always use ‘.gov’ domains.

How Scammers Trick You

Scammers craft messages that look legitimate, using language copied directly from official IRS documents. They play on emotions, urgency, and financial need to lure unsuspecting individuals into clicking malicious links. Once you click, they may:

- Steal personal information such as your Social Security number and banking details.

- Install malware on your device to gain unauthorized access.

- Trick you into making a fraudulent payment or providing sensitive data.

What to Do If You Receive a Scam Message

If you receive a suspicious text or email claiming to be from the IRS, follow these steps:

- Do Not Click Any Links – Avoid interacting with the message altogether.

- Delete the Message Immediately – Keeping it on your device increases the risk of accidental clicks.

- Report the Scam – Forward the message to the IRS at phishing@irs.gov and also report it to the Federal Trade Commission (FTC) at reportfraud.ftc.gov.

- Monitor Your Accounts – If you suspect you’ve shared personal information, keep a close watch on your bank accounts and credit reports for any unauthorized activity.

Stay Safe & Informed from Scammers

Scammers are getting more sophisticated, but staying informed can help you avoid falling victim to these fraudulent schemes. Remember, the IRS will never ask for personal information through text messages or emails. Always verify directly through the IRS website (www.irs.gov) or call their official number if you have concerns.

By spreading awareness, we can help prevent others from getting scammed. Stay vigilant, protect your personal information, and always double-check any unsolicited messages claiming to be from government agencies!

Claire Bennett is a seasoned finance writer with over 8 years of experience, specializing in personal finance and investment strategies. She has contributed to top media outlets like Forbes and Business Insider.