Palantir Technologies, a top data analytics, and AI software company, is a key player in the tech sector with a market valuation of around $190.76 billion as of February 2025.

Palantir is known for its advanced software platforms used by government and commercial clients. Recent reports show strong growth in U.S. commercial bookings and record customer net additions, highlighting its expanding presence in the AI industry.

Earnings calls are essential for investors, offering insights into a company’s financial performance, strategy, and future plans. In this article, I have provided a beginner-friendly, step-by-step guide to help you analyze Palantir’s earnings calls with real data and proven methods.

What Is an Earnings Call?

An earnings call is a conference call held by a company’s management each quarter to discuss its financial results. During these calls, executives present key components such as:

- Management Discussion: A review of financial highlights and strategic initiatives.

- Q&A Session: Analysts and investors ask questions to clarify performance and future expectations.

- Financial Highlights: Key metrics such as revenue, earnings per share (EPS), operating income, and margins are discussed.

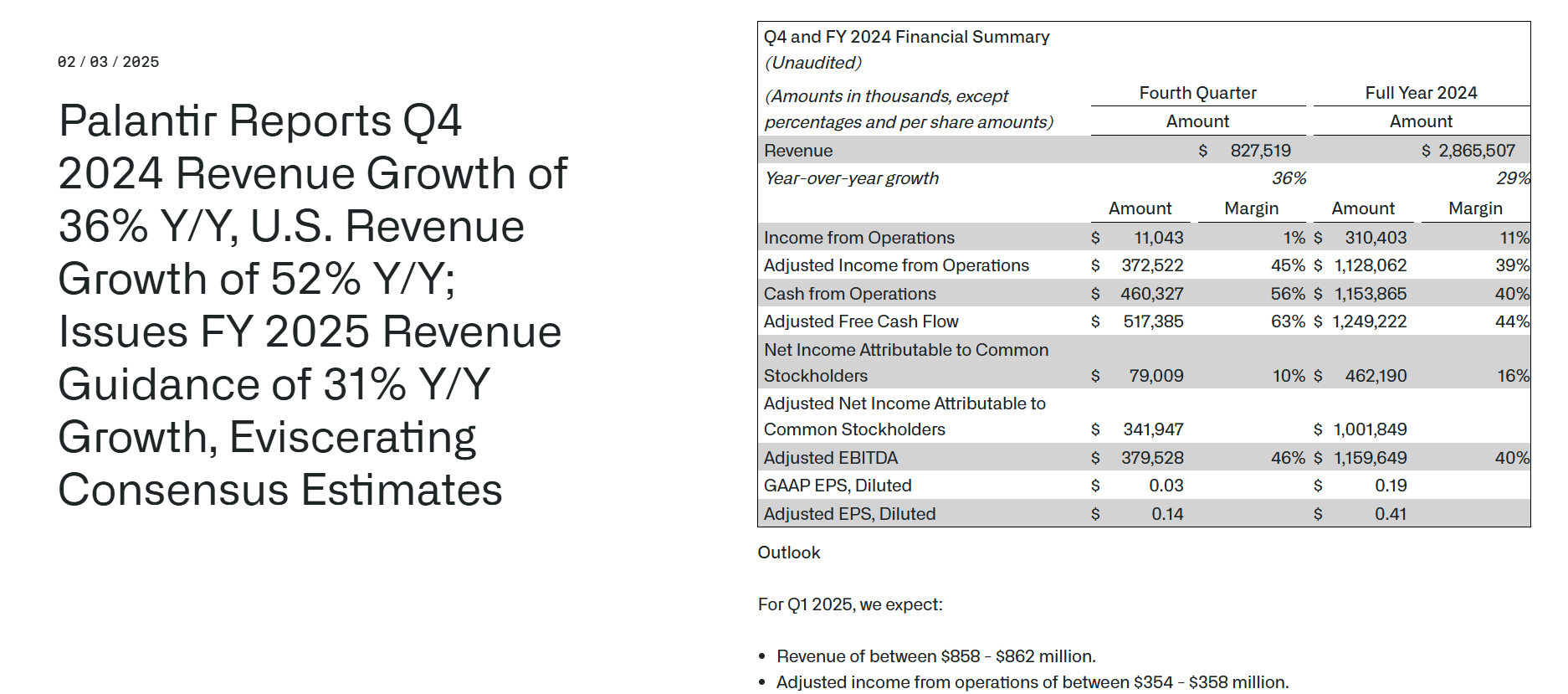

For instance, during Palantir’s recent Q4 2024 earnings call, management discussed revenue growth, margin expansion, and future revenue guidance (Palantir IR, ).

How Earnings Call Impacts on the Stock Performance

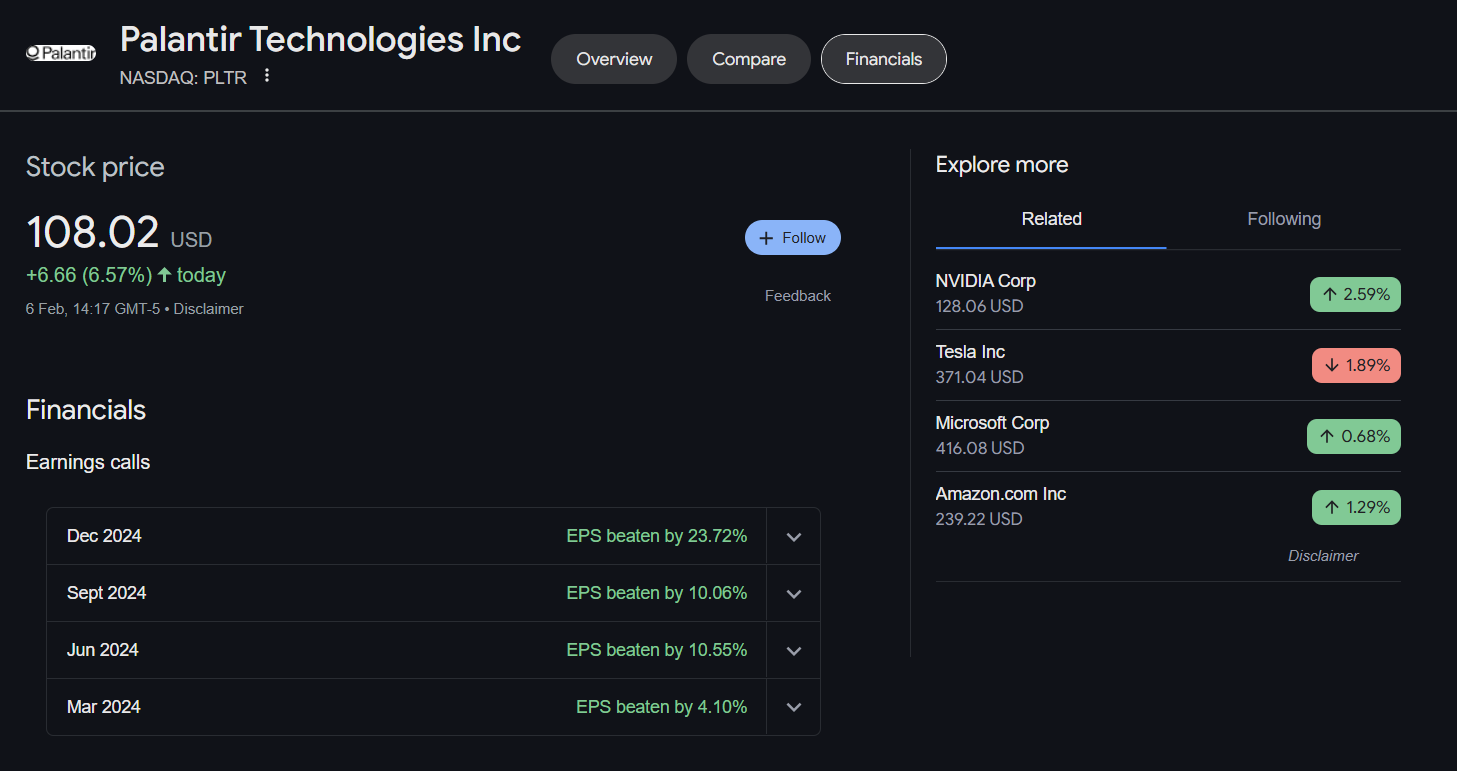

Earnings calls can significantly influence investor sentiment. Positive surprises in revenue, EPS, or forward guidance may lead to a surge in stock price. Conversely, any indication of caution or unexpected challenges can result in a decline. Analysts and investors closely watch these calls to adjust their expectations; as seen in recent market reactions where Palantir’s strong earnings contributed to a notable share price increase of over 20% in premarket trading.

Metrics Discussed in Earnings Call

During earnings calls, the following metrics are commonly highlighted:

- Revenue: Total income from the company’s operations.

- Earnings Per Share (EPS): Net income divided by the number of outstanding shares.

- Operating Income/Margins: Indicators of profitability.

- Future Guidance: Projections for upcoming quarters. For example, Palantir’s Q4 2024 report featured revenue of $828 million (up 27% YoY) and EPS of $0.14 compared to $0.11 in the previous quarter .

Palantir’s Earnings Call Highlights for Q4 2024

Revenue Growth and Financial Highlights

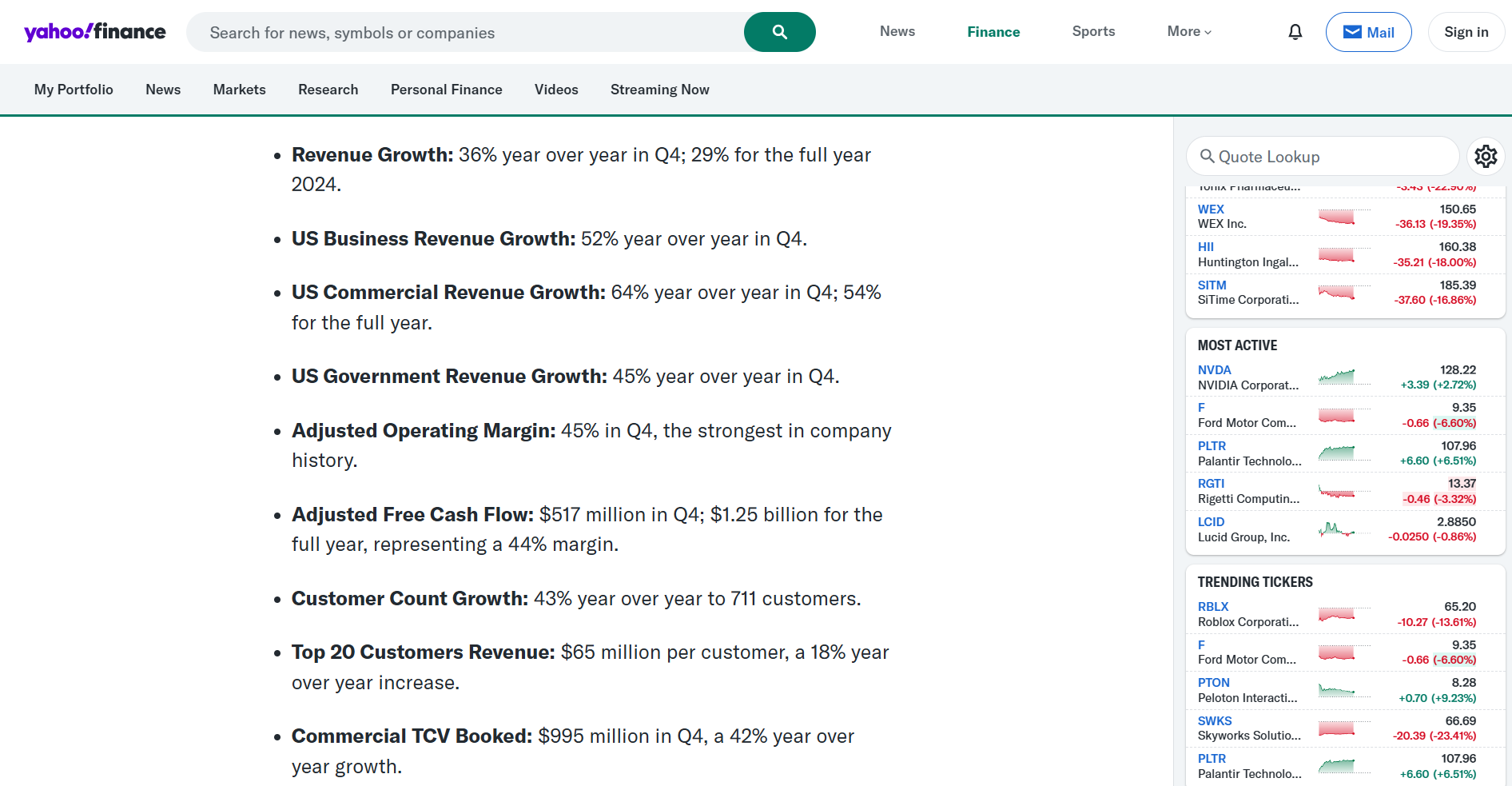

Palantir Technologies Inc (NASDAQ: PLTR) achieved remarkable revenue growth in Q4 2024, reporting a 36% year-over-year increase. For the full year, revenue grew 29%, surpassing expectations. This strong performance was driven by both commercial and government sectors, highlighting the company’s robust growth trajectory.

- Q4 Revenue Growth: +36% YoY

- Full Year 2024 Revenue Growth: +29%

US Business Performance

Palantir’s US business showed exceptional growth, with a 52% year-over-year increase in Q4 2024. Both commercial and government sectors contributed significantly to this success.

- US Business Revenue Growth: +52% YoY in Q4

- US Commercial Revenue Growth: +64% YoY in Q4; +54% for the full year

- US Government Revenue Growth: +45% YoY in Q4

Profitability and Cash Flow

The company reported its strongest adjusted operating margin in history, reaching 45% in Q4. Adjusted free cash flow was an impressive $517 million in Q4, with a full-year free cash flow of $1.25 billion, yielding a 44% margin.

- Adjusted Operating Margin: 45% in Q4

- Adjusted Free Cash Flow: $517 million in Q4; $1.25 billion for the full year

Customer Growth and Contract Value

Palantir continued to expand its customer base, increasing its customer count by 43% YoY, reaching a total of 711 customers. The Top 20 customers generated $65 million per customer, reflecting an 18% YoY increase.

Additionally, the company achieved significant growth in its commercial contract value:

- Commercial TCV Booked: $995 million in Q4 (+42% YoY)

- US Commercial TCV Booked: $803 million in Q4 (+134% YoY)

The company’s Total Remaining Deal Value now stands at $5.43 billion, up 40% YoY.

Global Performance and Retention Metrics

Internationally, Palantir saw a solid 28% YoY increase in government revenue, while international commercial revenue growth was more modest, at 3% YoY in Q4.

Palantir’s Net Dollar Retention was impressive at 120%, marking a 200-basis-point improvement from the previous quarter.

Earnings and Guidance

For Q4 2024, Palantir reported GAAP net income of $79 million and adjusted earnings per share (EPS) of $0.14. For the full year, GAAP EPS was $0.19, while adjusted EPS stood at $0.41. Looking ahead, Palantir provided strong guidance for Q1 2025 and the full year:

- Q1 2025 Revenue Guidance: $858 million to $862 million

- Full Year 2025 Revenue Guidance: $3.741 billion to $3.757 billion

Challenges and Future Forecast

While Palantir’s performance in Q4 was impressive, there were some challenges on the horizon. The European market showed slower growth, with only 4% growth representing 13% of the company’s business. Furthermore, revenue from strategic commercial contracts is expected to decline in Q1 2025, and Palantir anticipates higher expenses in 2025 due to investments in hiring and product development.

How can you analyze an Earnings Call as a beginner?

Step 1: Preparation

Before you start, gather all available materials:

- Earnings Call Transcript and Slides: Obtain these from Palantir’s investor relations website (investors.palantir.com) and other reliable sources.

- Historical Reports: Review previous earnings calls and quarterly reports to understand past performance.

- Set Objectives: Define what you want to learn—be it revenue trends, changes in margins, or future guidance.

Step 2: Listening or Reading the Call

As you engage with the call:

- Focus on Opening Remarks: Management’s opening comments often provide key insights into current performance.

- Identify Key Statements: Note any significant deviations from previous forecasts. For example, if management signals unexpected growth in commercial contracts, that is a critical point for analysis.

Step 3: Extracting Key Information

Extract the most important points from the web:

- Announcements: Identify the main announcements related to revenue, EPS, and operating margins.

- Management Tone: Listen carefully for any cautious or optimistic language, which can indicate future performance.

- Contextual Data: Note discussions about contract wins or challenges that may affect future guidance.

Step 4: Analyzing Financial Data

Compare the current figures with historical data:

- Growth Rates: Calculate and compare revenue and EPS growth rates.

- Profitability Trends: Assess how operating income and margins have changed over time.

- Expense Trends: Look at any commentary regarding changes in operating expenses.

Step 5: Contextual Analysis

Place the current performance within the broader market context:

- Market Trends: Compare Palantir’s performance with industry benchmarks and overall market trends.

- External Factors: Consider external factors such as economic conditions, regulatory changes, and technological trends that could influence future performance.

Step 6: Drawing Conclusions

Based on your analysis:

- Impact on Stock: Summarize the potential impact on Palantir’s stock performance.

- Actionable Insights: Identify any areas that warrant further investigation or questions that remain unanswered.

- Long-Term Outlook: Consider how the current performance fits into the company’s long-term strategic goals.

Practical Application: A Case Study Example

Let’s apply this method with a recent case study. In Palantir’s Q4 2024 earnings call:

- Revenue: The company reported $828 million in revenue, up 27% YoY, signaling robust demand for its AI-driven solutions (investors.palantir.com ).

- EPS Growth: EPS increased from $0.11 to $0.14, reflecting a 27% improvement, which is a key indicator of profitability.

- Guidance: Management provided Q1 2025 revenue guidance of $858–$862 million, indicating confidence in continued growth.

- Management Commentary: Executives emphasized strong growth in U.S. commercial bookings and record customer net adds, which supports future revenue potential.

By following each of the steps—preparing your materials, actively listening or reading the transcript, extracting and analyzing key information, and then placing it in context—you can develop a well-rounded view of Palantir’s performance. I encourage you to compare this structured analysis with your own observations to refine your investment approach.

FAQ

A1: An earnings call is a quarterly review of a company’s financials and future outlook. It’s vital for investors to understand revenue, EPS, margins, and strategy, which affect stock performance.

A2: Focus on revenue, EPS, operating income, and future guidance. For example, in Q4 2024, Palantir reported $828M in revenue and $0.14 EPS, key for assessing growth.

A3: Gather the transcript, slides, and presentations from Palantir’s IR site. Review past reports for context and define your analysis goals.

A4: Common mistakes include focusing too much on short-term results, ignoring market trends, and not verifying management’s statements with data.

Hi, my name is Nikita Joshi, a graduate of Hindu College, Delhi University, and a passionate blogger. With 8 years of experience in On-Page SEO and Proofreading, I specialize writing content that not only resonates with readers but also ranks well on search engines. My work also includes moderating content at APPE, where I ensure high-quality content by maintaining the standards of accuracy and relevance. I focus on delivering valuable information, particularly covering Nationwide Announcements and Finance, and consistently aim to provide insightful content to my audience.